Renovating your house is a great opportunity to create the home of your dreams or maximize your current residence. Your contractor can help you design a renovation plan that fits your goals.

It is important to first determine how much money you are willing to spend and how long it will take to complete a renovation. If you want to get everything done at once, it's tempting. But if your budget and time are not planned out, or if the amount of money you plan to spend isn't accurate, you might end up paying more than expected, or even worse, running into problems you can't fix.

It is also important to look at the prices of similar homes that have recently sold in your neighborhood. It may be tempting for you to upgrade your home to a level that is above the neighborhood average, but this can make it hard to sell.

It is a good investment to increase the value of your house for future sales. However, it can be a big risk for your family. It's likely that you will need to increase the amount of insurance on your home to protect its new higher value.

A good idea is to hire a designer or architect to draft the plans for your renovations before you begin the actual work. This will save you a lot of money and frustration in the long run as well as ensure that the remodelled property meets your specific needs and aesthetic desires.

Before starting the renovations, you will need the board of your co-op to grant you a permit. The type and scope of renovation will determine the permits required.

Depending on what you're doing, you might need a roof, foundation, siding or window permit. You'll need to start with the most important projects, as they will have a major impact on other renovations.

Once you have completed the larger projects, you can begin smaller and easier ones. This will allow you to finish each section of your renovation quickly and without a significant delay in your day-to-day life.

When choosing a flooring material, choose something that is durable and easy to clean. For most living areas, such as bedrooms and living rooms, laminate flooring is the best option. Ceramic tile and marble are popular choices for bathrooms and kitchens.

If you're not sure what kind of flooring you want, it's a good idea to talk with a few local contractors and visit different showrooms to get a sense of what is available and what will suit your specific space. The right flooring will make a big difference in the appearance of your home renovation.

FAQ

How long does it take to get a mortgage approved?

It is dependent on many factors, such as your credit score and income level. It usually takes between 30 and 60 days to get approved for a mortgage.

What flood insurance do I need?

Flood Insurance covers flooding-related damages. Flood insurance protects your possessions and your mortgage payments. Learn more information about flood insurance.

Can I get another mortgage?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

How do I calculate my interest rate?

Market conditions can affect how interest rates change each day. In the last week, the average interest rate was 4.39%. The interest rate is calculated by multiplying the amount of time you are financing with the interest rate. For example, if you finance $200,000 over 20 years at 5% per year, your interest rate is 0.05 x 20 1%, which equals ten basis points.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

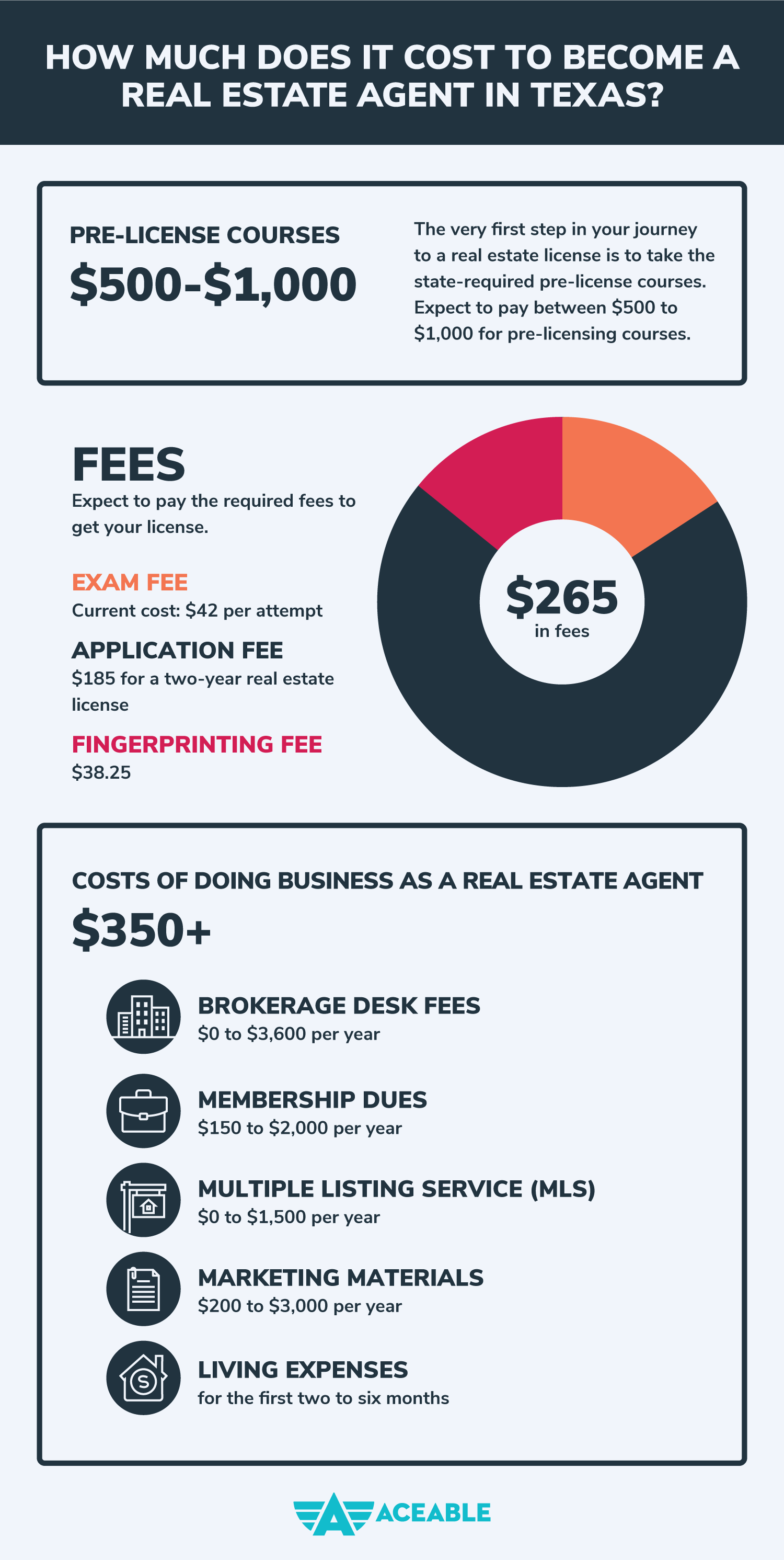

How to become an agent in real estate

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next you must pass a qualifying exam to test your knowledge. This requires that you study for at most 2 hours per days over 3 months.

You are now ready to take your final exam. In order to become a real estate agent, your score must be at least 80%.

All these exams must be passed before you can become a licensed real estate agent.