Net proceeds are the total amount a merchant receives after taking out all of the expenses associated with selling a product, service or asset. These include taxes, fees, commissions, and any other transaction costs. Although a good or service might have a greater gross proceeds than its net proceeds, this does not necessarily mean it is the best price to be sold at.

Net proceeds can be higher than gross proceeds when a business is sold or assets are transferred. This is because the capital gain tax is calculated on the net proceeds instead of the gross proceeds.

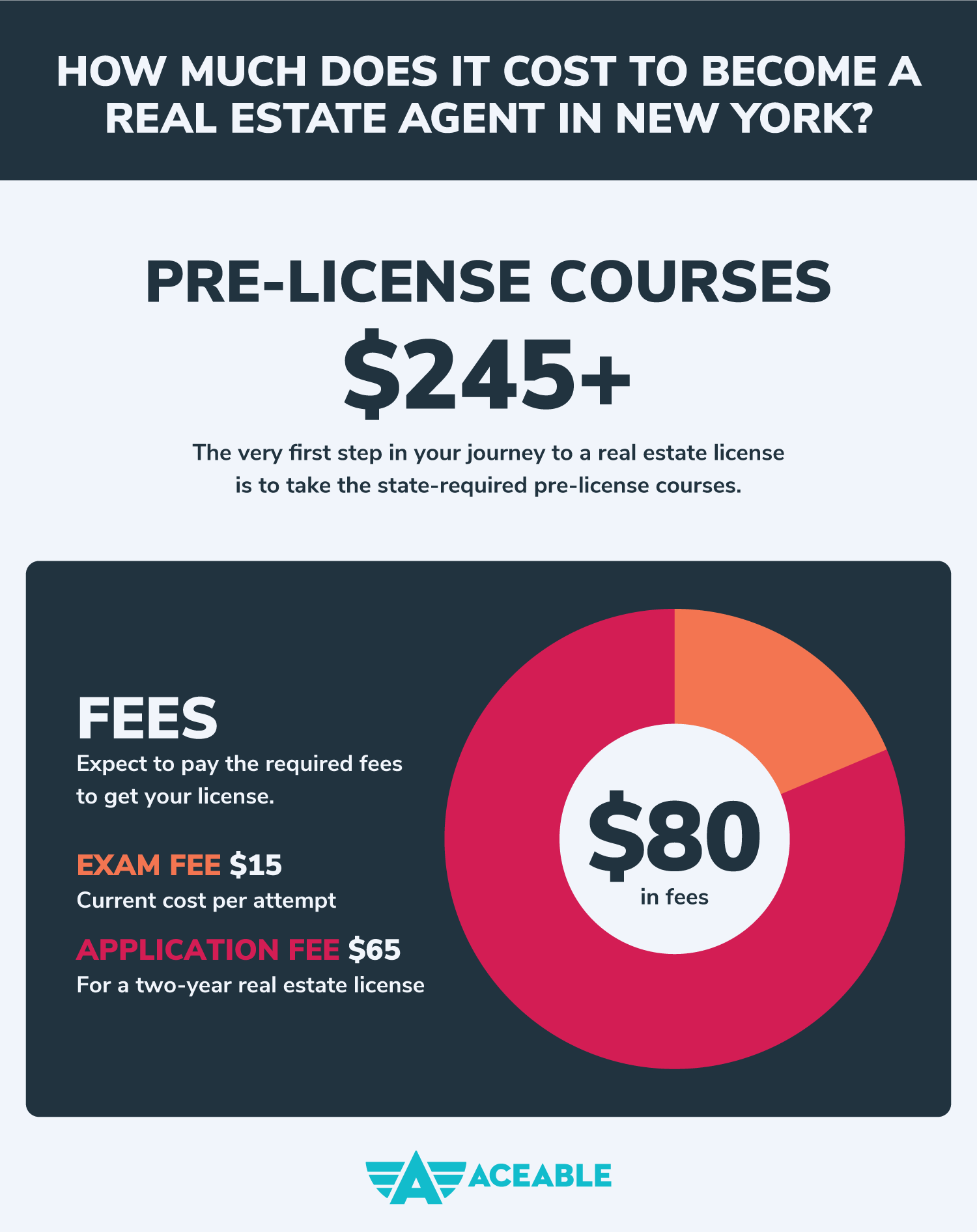

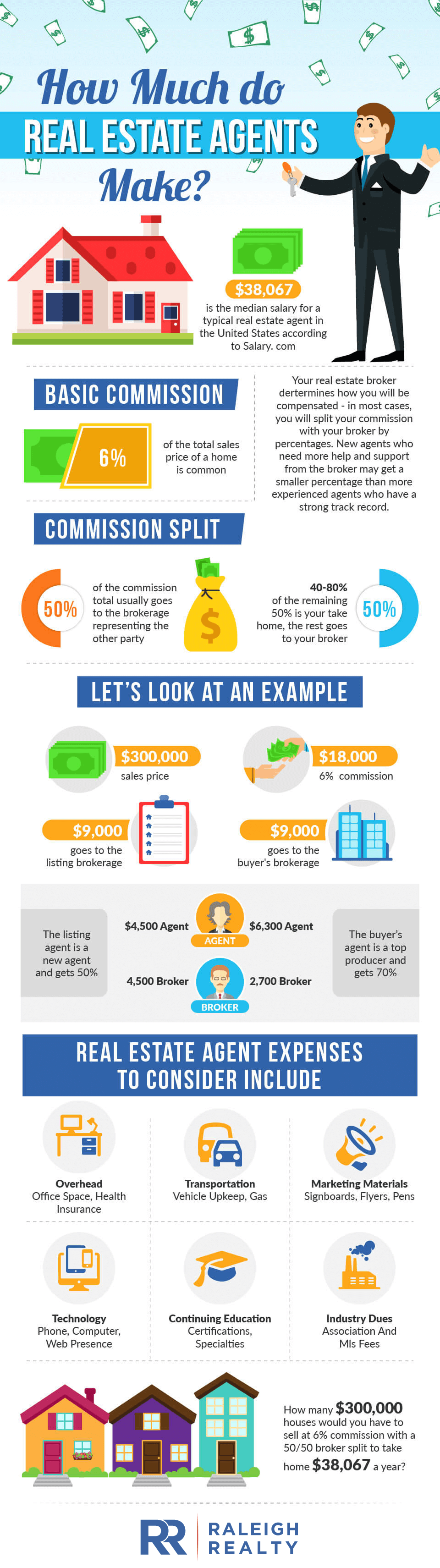

In order to determine the net proceeds from a real estate transaction, you need to subtract the cost of selling the property from the sales price. This includes fees and costs for listing the home on the marketplace, hiring a Realtor, and the escrow process.

This is something you need to think about because these costs can quickly add-up if they aren't managed well. These costs can also impact your decision to buy a new house after you've sold your existing one.

It doesn't matter what your financial situation is or how much you intend to spend on a new house, you need to be aware of the potential impact. By advocating for yourself and negotiating lower rates and fees any time you can, you can make sure that you have the money you need to buy your next house and pay off the mortgage.

You should have your home inspected prior to putting it up for sale. It will give you an idea of what repairs are needed and can help buyers get a better understanding of the property's quality. You should also agree to any seller concessions. These are often negotiated in contract negotiations and can cost you a lot of money.

To make your home appealing to potential buyers, you should hire a professional to stage it. This will make your home more attractive and sell faster. It can be quite expensive, but the return on investment is well worth it.

You should account for any seller concessions you might have made in your sales contract when calculating your net proceeds. This could be a reduction in your commissions and closing cost or covering some buyer's fee.

Many factors can impact the net proceeds of the sale of your house, such as how the property is sold and whether it is an all-cash deal. You can structure some real estate transactions so that the seller gets cash in exchange to a certain percentage equity.

It is important to note, however, that these numbers can be impacted by the state of the real estate market and your location. They do not give a full picture of what to expect from the sale or purchase of your home.

FAQ

Is it possible for a house to be sold quickly?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. Before you sell your house, however, there are a few things that you should remember. First, you need to find a buyer and negotiate a contract. You must prepare your home for sale. Third, it is important to market your property. Lastly, you must accept any offers you receive.

How can I determine if my home is worth it?

It could be that your home has been priced incorrectly if you ask for a low asking price. If your asking price is significantly below the market value, there might not be enough interest. You can use our free Home Value Report to learn more about the current market conditions.

What amount should I save to buy a house?

It depends on how much time you intend to stay there. If you want to stay for at least five years, you must start saving now. You don't have too much to worry about if you plan on moving in the next two years.

How much does it cost for windows to be replaced?

Replacing windows costs between $1,500-$3,000 per window. The total cost of replacing all your windows is dependent on the type, size, and brand of windows that you choose.

How do I calculate my interest rates?

Market conditions influence the market and interest rates can change daily. The average interest rate during the last week was 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

What should you consider when investing in real estate?

It is important to ensure that you have enough money in order to invest your money in real estate. If you don't have any money saved up for this purpose, you need to borrow from a bank or other financial institution. It is also important to ensure that you do not get into debt. You may find yourself in defaulting on your loan.

You should also know how much you are allowed to spend each month on investment properties. This amount must include all expenses associated with owning the property such as mortgage payments, insurance, maintenance, and taxes.

You must also ensure that your investment property is secure. It would be a good idea to live somewhere else while looking for properties.

What are the top three factors in buying a home?

When buying any type or home, the three most important factors are price, location, and size. Location is the location you choose to live. Price refers how much you're willing or able to pay to purchase the property. Size is the amount of space you require.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to buy a mobile house

Mobile homes are houses constructed on wheels and towed behind a vehicle. They were first used by soldiers after they lost their homes during World War II. Mobile homes are still popular among those who wish to live in a rural area. Mobile homes come in many styles and sizes. Some houses can be small and others large enough for multiple families. Even some are small enough to be used for pets!

There are two main types of mobile homes. The first type is manufactured at factories where workers assemble them piece by piece. This occurs before delivery to customers. A second option is to build your own mobile house. Decide the size and features you require. Next, make sure you have all the necessary materials to build your home. The permits will be required to build your new house.

These are the three main things you need to consider when buying a mobile-home. You might want to consider a larger floor area if you don't have access to a garage. A larger living space is a good option if you plan to move in to your home immediately. You should also inspect the trailer. You could have problems down the road if you damage any parts of the frame.

You should determine how much money you are willing to spend before you buy a mobile home. It's important to compare prices among various manufacturers and models. Also, take a look at the condition and age of the trailers. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

An alternative to buying a mobile residence is renting one. Renting allows the freedom to test drive one model before you commit. Renting is not cheap. Renters usually pay about $300 per month.