You can make a great career by becoming a licensed real estate agent. It allows you to make your own hours, generate extra income, and help others in their home-buying or securing process. But you need to follow a certain set of steps before you can get started.

How to become a Michigan real estate agent

First, you will need to complete the education required and then pass the state examination to receive your Michigan real estate license. Fortunately, the process is easy and relatively quick. Start by looking for a school offering real estate training courses that are approved by the Michigan Department of Licensing and Regulatory Affairs.

You'll need to choose a course that covers all the fundamentals you need to know in order to pass the Michigan real estate licensing exam and to start your career as a real estate salesperson. This course should cover subjects such as property ownership and laws of agency.

The first step is to register with the Michigan Department of Licensing & Regulatory Affairs for a license. You will need to create an account, pay $88 for an application fee and then you can start working.

Once you've paid your application and license fees, LARA will send you an email that provides you with an exam candidate ID number and instructions for registering to take the real estate exam. This usually takes between 2-5 days for you to receive.

After you pass the real estate licensing exam, you need to find a sponsoring broker who will verify your exam results. This broker must sign the Employing Broker Notice form.

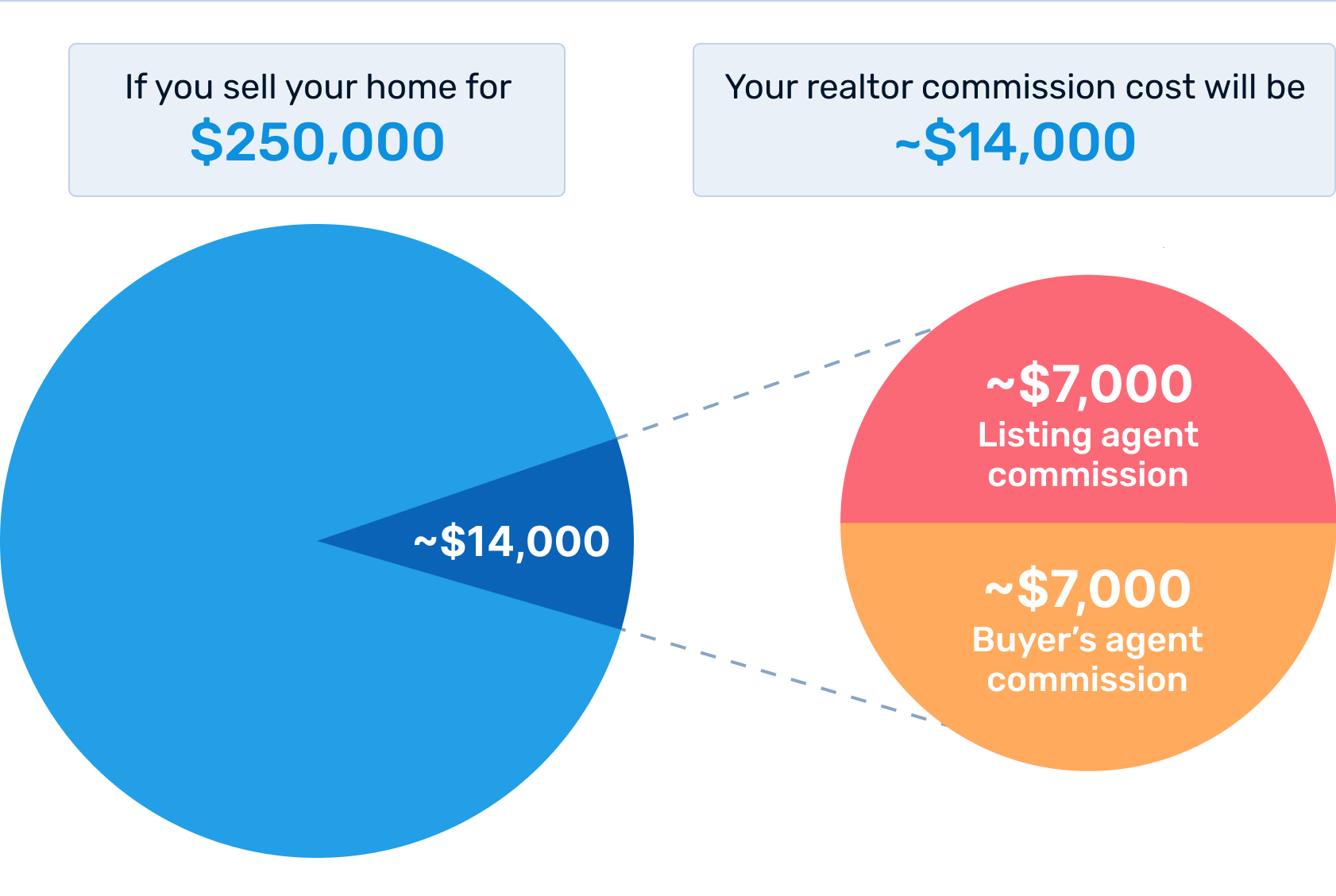

It's important to choose the right broker because this person will represent you and make decisions on your behalf as you work your way up the real estate career ladder. There are many things to look at, including their commission structure as well the way they support their agents by providing education and training.

The best brokers will be willing to talk with you about your career goals, as well as offer guidance and advice on the best ways to promote yourself and your skills in the market. Look into their sales and client management experience.

A good brokerage will also provide you with a mentor or coach who can help you navigate the ins and outs of the industry. The mentor or coach may also have a long history of success in real estate.

How to get a mireal estate license

To become a licensed real estate agent in Michigan, you need to complete a 40-hour real estate salesperson pre-licensing course. These courses can be found in a range of schools, including online and on-campus. Many of these schools also offer additional resources, such as exam prep and post-licensing training.

Michigan's top online real estate classes focus on current law, industry practices, and the most successful. They will help to understand the current real estate market and how clients should be treated. They will also help to prepare you for the real-estate license exam and give you a strong reputation in this industry.

FAQ

How can I tell if my house has value?

Your home may not be priced correctly if your asking price is too low. If your asking price is significantly below the market value, there might not be enough interest. Our free Home Value Report will provide you with information about current market conditions.

Should I buy or rent a condo in the city?

Renting is a great option if you are only planning to live in your condo for a short time. Renting saves you money on maintenance fees and other monthly costs. However, purchasing a condo grants you ownership rights to the unit. The space can be used as you wish.

Do I need flood insurance?

Flood Insurance covers flood damage. Flood insurance protects your possessions and your mortgage payments. Learn more information about flood insurance.

What are the cons of a fixed-rate mortgage

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to Manage A Rental Property

Renting your home can be a great way to make extra money, but there's a lot to think about before you start. These tips will help you manage your rental property and show you the things to consider before renting your home.

This is the place to start if you are thinking about renting out your home.

-

What is the first thing I should do? Take a look at your financial situation before you decide whether you want to rent your house. If you have outstanding debts like credit card bills or mortgage payment, you may find it difficult to pay someone else to stay in your home while that you're gone. Also, you should review your budget to see if there is enough money to pay your monthly expenses (rent and utilities, insurance, etc. You might find it not worth it.

-

How much is it to rent my home? The cost of renting your home depends on many factors. These factors include your location, the size of your home, its condition, and the season. You should remember that prices are subject to change depending on where they live. Therefore, you won't get the same rate for every place. Rightmove shows that the median market price for renting one-bedroom flats in London is approximately PS1,400 per months. This means that your home would be worth around PS2,800 per annum if it was rented out completely. While this isn't bad, if only you wanted to rent out a small portion of your house, you could make much more.

-

Is it worth it. It's always risky to try something new. But if it gives you extra income, why not? Make sure that you fully understand the terms of any contract before you sign it. It's not enough to be able to spend more time with your loved ones. You'll need to manage maintenance costs, repair and clean up the house. Make sure you've thought through these issues carefully before signing up!

-

Are there benefits? So now that you know how much it costs to rent out your home and you're confident that it's worth it, you'll need to think about the advantages. There are many reasons to rent your home. You can use it to pay off debt, buy a holiday, save for a rainy-day, or simply to have a break. It's more fun than working every day, regardless of what you choose. If you plan well, renting could become a full-time occupation.

-

How do I find tenants Once you've made the decision that you want your property to be rented out, you must advertise it correctly. Listing your property online through websites like Rightmove or Zoopla is a good place to start. Once you receive contact from potential tenants, it's time to set up an interview. This will enable you to evaluate their suitability and verify that they are financially stable enough for you to rent your home.

-

What are the best ways to ensure that I am protected? If you are worried about your home being empty, it is important to make sure you have adequate protection against fire, theft, and damage. You'll need to insure your home, which you can do either through your landlord or directly with an insurer. Your landlord will usually require you to add them as additional insured, which means they'll cover damages caused to your property when you're present. However, this doesn't apply if you're living abroad or if your landlord isn't registered with UK insurers. In such cases you will need a registration with an international insurance.

-

It's easy to feel that you don't have the time or money to look for tenants. This is especially true if you work from home. Your property should be advertised with professionalism. It is important to create a professional website and place ads online. A complete application form will be required and references must be provided. Some people prefer to do everything themselves while others hire agents who will take care of all the details. It doesn't matter what you do, you will need to be ready for questions during interviews.

-

What should I do after I have found my tenant? If you have a contract in place, you must inform your tenant of any changes. If you don't have a lease, you can negotiate length of stay, deposit, or other details. You should remember that although you may be paid after the tenancy ends, you still need money for utilities.

-

How do you collect the rent? When it comes time for you to collect your rent, check to see if the tenant has paid. You will need to remind your tenant of their obligations if they don't pay. You can subtract any outstanding rent payments before sending them a final check. If you're struggling to get hold of your tenant, you can always call the police. They will not normally expel someone unless there has been a breach of contract. However, they can issue warrants if necessary.

-

How can I avoid problems? You can rent your home out for a good income, but you need to ensure that you are safe. Make sure you have carbon monoxide detectors installed and security cameras installed. Make sure your neighbors have given you permission to leave your property unlocked overnight and that you have enough insurance. Finally, you should never let strangers into your house, even if they say they're moving in next door.