A contingent offer is an agreement between a buyer and seller that stipulates that certain conditions must be met before the sale can proceed. These conditions can include a home inspection, appraisal or mortgage. You can have a lawyer help you design your offer and to execute it with all of the contingencies.

House Sale Contingency

A home inspection contingency, which is the most common house sale contingency, is the most prevalent. Buyers who wish to avoid buying a property with problems discovered during a home inspection use this type of contingency. If there are issues discovered during the home inspection that cannot be repaired, buyers have the option to cancel the contract and get their earnest money deposit back.

An appraisal contingency is another common house sale contingency. This is a contingency that buyers who have a mortgage use to protect themselves against losing their earnest funds if the appraisal is lower then the property's value.

A buyer can use this contingency to stop a fraudulent purchase or sale. By adding a clause saying that the seller must pay all liens to the property before closing, you can prevent fraud.

Home Sale Contingency

This is a risky sale contingency because the seller has to be ready to accept an offer on a property that may or may not go through, depending on how long it takes the buyer to sell their current home. This is a big risk for the seller and many sellers won't accept it.

Sellers who accept a contingent deal will still have to make improvements and cosmetic changes to their house, then list it, show it to buyers and evaluate offers. If the buyer declines to be approved for a mortgage, or their offer falls short, the seller will need to accept a backup offer from a potential buyer while they wait for the house's closing.

A contingent listing, which allows sellers to attract large numbers of potential buyers during a house sale market, can be a great way to sell their home while it is being listed. This can be particularly useful for homes in downturn or for those that have been on the housing market for a longer duration.

Contingent sales don't happen as often in seller's markets where there are a lot of homes for sale but fewer qualified buyers. These markets are more likely to see the original buyer leave their deal before it can close.

A contingent sale may be a great opportunity for buyers to buy their dream home and protect their earnest funds deposit. But, the contingency will only be as strong or as secure as the buyer's offer. Before you make an offer on any property, it is important to consider the possibility of losing your earnest money deposit.

FAQ

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. A steep loss could also occur if you sell your home before the term ends due to the difference in the sale price and outstanding balance.

Is it possible to quickly sell a house?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. There are some things to remember before you do this. You must first find a buyer to negotiate a contract. Second, prepare the house for sale. Third, your property must be advertised. Finally, you need to accept offers made to you.

What are the benefits to a fixed-rate mortgage

Fixed-rate mortgages allow you to lock in the interest rate throughout the loan's term. This guarantees that your interest rate will not rise. Fixed-rate loans come with lower payments as they are locked in for a specified term.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

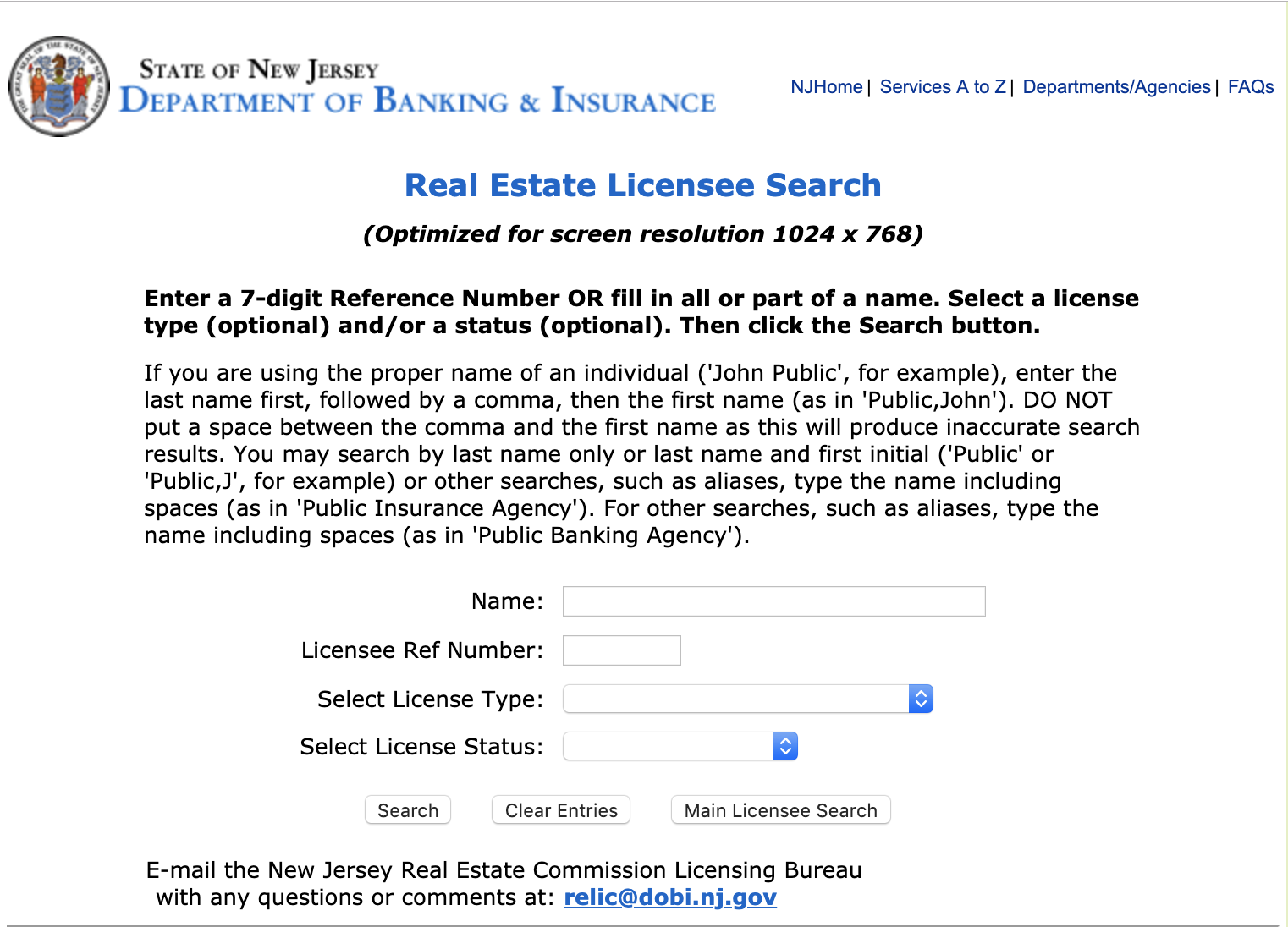

How to be a real-estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This means that you will need to study at least 2 hours per week for 3 months.

After passing the exam, you can take the final one. To be a licensed real estate agent, you must achieve a minimum score of 80%.

Once you have passed these tests, you are qualified to become a real estate agent.