You can easily get your Minnesota real estate license by following a few simple steps. These include the requirements of Pre-licensing Education, the realty examination, and how much it will cost. You will also find helpful resources such as the StateRequirement Guide. Read on to learn more. Here are some tips to make the process go as smoothly as possible. After reading the guides, it should not take you long to pass the exam.

Pre-licensing education

In Minnesota, obtaining a real estate license requires you to complete 30 hours of pre-licensing education. You can do this by completing a real estate course offered by Pearson. This course contains a real-estate dictionary and eBooks. Pearson VUE allows you to apply for your license after you have completed your pre-licensing education. You will need to create an account and pay $63 to take the exam.

Two forms of identification are required to pass the real estate exam. Your picture and signature must appear on your primary ID. A second ID must be valid and present the same details. Other expenses will arise during the course. However, you may apply for your Minnesota Commercial Division license where you can receive guidance and a diploma. You'll need the Broker or Standard Salesperson license to sell Minnesota commercial realty.

Exam requirements

It is important to fully understand the requirements and examination process before you start a career as a real estate agent. A license is the authorization to practice. The exam helps to ensure that the person meets certain standards. It protects the public by ensuring the person who is licensed to practice real estate is competent and qualified. Pearson VUE is the leading provider of assessment and licensing services for Minnesota.

Both the national and the state portion must be passed to earn your real estate license. The exams are administered by a state-approved testing centre and are divided into two parts: the state and national portions. You will be found guilty of gross misdemeanor if you fail the exam. You can't work as a broker or real estate agent until you have the license.

Requirements

To ensure your license is up-to-date you will need to complete continuing education courses. You'll want to make the most of continuing education opportunities whether you are involved in a new transaction or starting the renewal process. Minnesota law requires you to complete at least one continuing-education course every two year. But that doesn't mean you have to stop taking more. At least 90 hours should be spent on the courses. To make the requirements for renewal of your Minnesota real estate license easier to manage, take at least 15 hours of continuing education each year.

A requirement for continuing education is to complete at most 22.5 hours of approved continuing educational courses. Specifically, you should take at least one continuing education course related to real estate law, rules, and court cases. You should take at least one hour course on fair housing and agency law. A training course that is specifically tailored for agents, brokers, or real estate agents can help you earn continuing education credits.

Cost

You must complete 90 hours in pre-licensing training before you can become licensed Minnesota real estate agents. Taking courses online or in a classroom setting is both acceptable. Online courses are usually the most affordable. The cost of standalone courses ranges from $200 to $300. You must have two forms of identification to apply for a license in Minnesota. You must have a valid government-issued ID with a photo and signature. You will also need a secondary ID that is valid, with a photo and signature. In addition to the pre-licensing education, you will need to pay for other fees.

Minnesota's application fees include a technology surcharge, a research and education fund, and a fee for the processing of your application. It is not refundable if you fail to fill out the entire application. You can pay the $110 application fees with a credit or debit card. To be eligible for a real estate license, you must have an income of at least $50,000 and three years of real estate experience. Minnesota requires that you be at least eighteen years old. You need to have either a bachelor's or at least two college years.

FAQ

Do I need to rent or buy a condo?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting allows you to avoid paying maintenance fees and other monthly charges. The condo you buy gives you the right to use the unit. You are free to make use of the space as you wish.

Is it better buy or rent?

Renting is usually cheaper than buying a house. It is important to realize that renting is generally cheaper than buying a home. You will still need to pay utilities, repairs, and maintenance. There are many benefits to buying a home. You will have greater control of your living arrangements.

What flood insurance do I need?

Flood Insurance covers flood damage. Flood insurance protects your possessions and your mortgage payments. Learn more about flood coverage here.

What are the top three factors in buying a home?

The three most important things when buying any kind of home are size, price, or location. It refers specifically to where you wish to live. Price refers to what you're willing to pay for the property. Size refers to how much space you need.

What are the drawbacks of a fixed rate mortgage?

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

How can I fix my roof

Roofs can burst due to weather, age, wear and neglect. Minor repairs and replacements can be done by roofing contractors. Get in touch with us to learn more.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

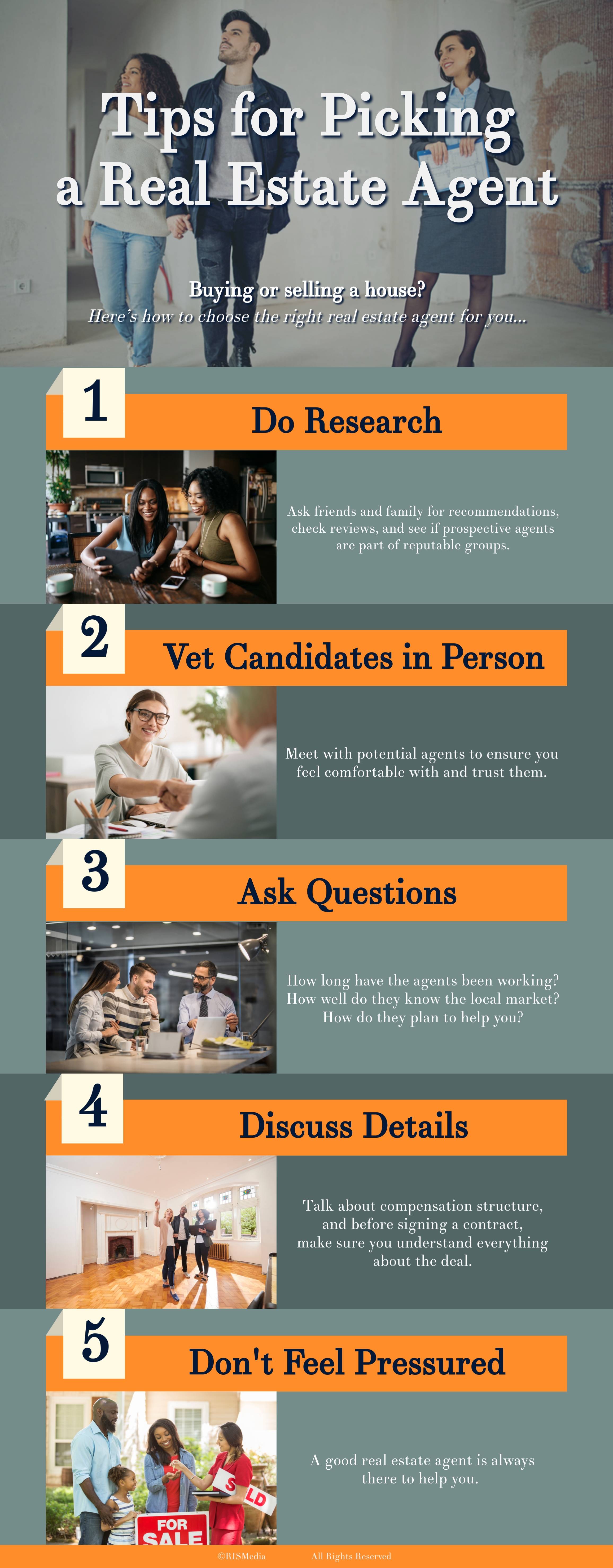

How to be a real-estate broker

You must first take an introductory course to become a licensed real estate agent.

Next, pass a qualifying test that will assess your knowledge of the subject. This means that you will need to study at least 2 hours per week for 3 months.

After passing the exam, you can take the final one. In order to become a real estate agent, your score must be at least 80%.

These exams are passed and you can now work as an agent in real estate.